Wondering how long it takes to withdraw money from 1win in India? This guide gives you a clear look at 1win withdrawal time in 2024, including method comparisons, average processing times, and tips to speed up your cashouts. Read on to ensure you get your winnings without delay.

How Fast Are 1win Withdrawals in India?

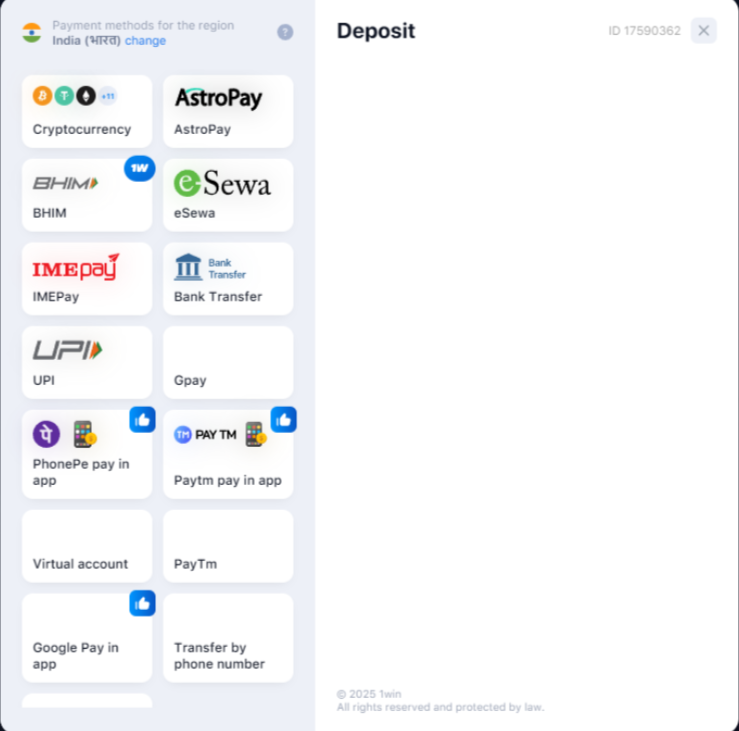

The withdrawal speed depends on the method used. On average, here's what users report in India:

- UPI: 12–36 hours

- Paytm: 30–90 minutes

- Bank Transfer: 2–5 business days

- USDT (Crypto): 10–30 minutes

Among these, cryptocurrency withdrawals are consistently the fastest. UPI is reliable but tends to be slower during bank holidays or weekends.

What Factors Affect 1win Withdrawal Time?

1. Account Verification (KYC)

If you haven't completed your KYC, your withdrawal will be held. Make sure to submit PAN, Aadhaar, and address proof right after registering.

2. Withdrawal Amount

Large withdrawals (₹50,000+) may require manual review, which can add several hours or even days.

3. Payment Method

Some gateways (like UPI or bank transfers) are processed during banking hours only. Crypto runs 24/7, even on holidays.

4. Network Load

During IPL or other big events, transaction delays may happen due to high volume on 1win servers or payment providers.

Comparison of Withdrawal Methods in India

| Method | Average Time | Processing Fees | Recommended? |

|---|---|---|---|

| UPI | 12–36 hrs | None | Yes (if KYC done) |

| Paytm | 30–90 mins | None | Highly recommended |

| Bank Transfer | 2–5 days | Varies by bank | Only for large amounts |

| Crypto (USDT) | 10–30 mins | 0.5–1% | Best for speed |

How to Speed Up Your Withdrawals

- Complete KYC early: Don’t wait until you win. Upload all required documents after signup.

- Use Paytm or USDT: These are the fastest methods available in India.

- Avoid weekends: Withdrawals via UPI/bank may stall on Saturdays and Sundays.

- Double-check your details: Mistakes in UPI ID or bank info will cause rejection.

Is 1win Reliable for Withdrawals in India?

Yes, 1win is generally reliable as long as your account is verified. Thousands of Indian players successfully withdraw money daily using Paytm and crypto. Support is available via live chat if something goes wrong.

User Testimonials

- Sahil, Hyderabad: “I withdrew ₹3,000 via Paytm. It took 40 minutes. No issues.”

- Meena, Delhi: “Bank transfer took 4 days, but the amount arrived.”

- Ramesh, Chennai: “USDT was super fast. Funds arrived in 15 minutes.”

FAQ

- Which method is the fastest? — USDT and Paytm are the quickest options.

- Does 1win charge withdrawal fees? — No for most methods; crypto may have minor fees.

- Can I withdraw without KYC? — No, KYC is mandatory for any withdrawal.

- Is 1win legal in India? — 1win holds a Curaçao license. Legality depends on your state.

- What is the minimum withdrawal? — Usually ₹500, but varies by method.